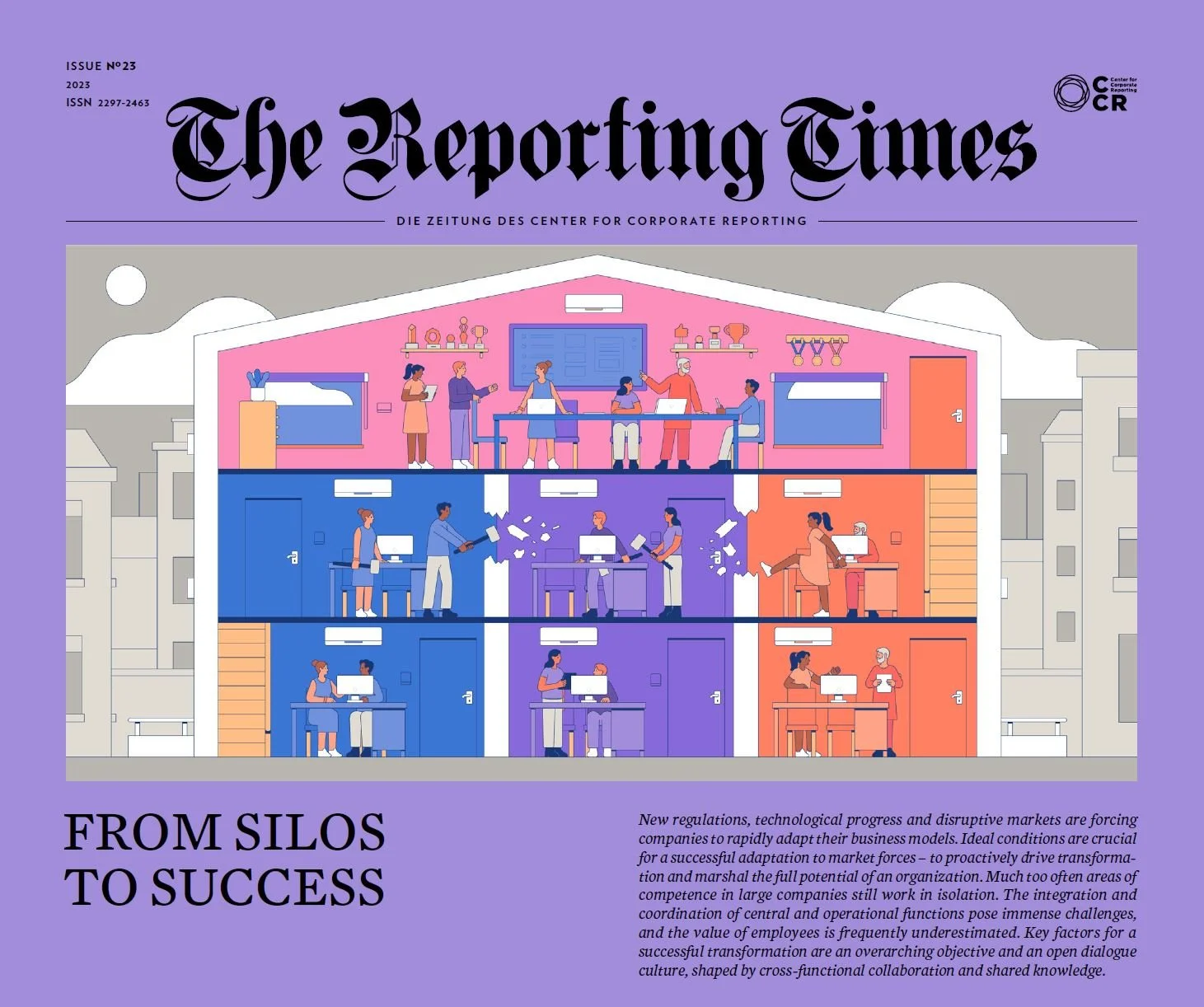

New regulations, technological progress and disruptive markets are forcing companies to rapidly adapt their business models. Ideal conditions are crucial for a successful adaptation to market forces – to proactively drive transformation and marshal the full potential of an organization. Much too often areas of competence in large companies still work in isolation. The integration and coordination of central and operational functions pose immense challenges, and the value of employees is frequently underestimated. Key factors for a successful transformation are an overarching objective and an open dialogue culture, shaped by cross-functional collaboration and shared knowledge.

Raus aus den Silos – Netzwerke als Erfolgsgarant?

Lesen Sie hier Editorial und Lead der 23. Ausgabe der Reporting Times.

By Tjeerd Krumpelman with Solange Rouschop

As Chief Sustainability Officer at ABN AMRO, Solange Rouschop focuses on finding business opportunities that contribute to sustainable top-line growth and building an integrated sustainability model to create impact for the bank and for its stakeholders. What are her aspirations? How important is integrated thinking? And how supportive can reporting be, in Solange’s opinion?

Von Heike Bruch und Lena Rudolf

Die Arbeitswelt unterliegt tiefgreifenden Veränderungen, angetrieben von Megatrends wie Digitalisierung, Arbeitskräftemangel und Nachhaltigkeit, die Innovation auch in der Art der Zusammenarbeit erfordern. Um dies zu meistern, stehen Unternehmen vor der Herausforderung, sich in Richtung einer Netzwerkorganisation zu wandeln. Dabei erfordern Trends wie der Abbau von Hierarchien, die Förderung von Selbstorganisation und Verantwortungsübernahme ein Umdenken bezüglich der Führung.

By Sallie Pilot

In the dynamic landscape of modern business, addressing pressing challenges like climate change, biodiversity loss and equitable transitions demands a fundamental shift in societal mindsets and corporate conduct. Businesses, regardless of size or ownership, wield substantial influence over the world’s fabric – from individuals to environments – through their offerings, operations and ecological impact.

Von Mikael Krogerus und Roman Tschäppeler

Wenn man Zusammenarbeit in einen einzigen Satz fassen müsste, so wäre es dieser: There is no «I» in Team.

By Maurus Lienhard and Philipp Haumüller

In early July 2022, Dufry, the global travel retail player, announced a business combination with Autogrill, a global travel food & beverage (F&B) operator. The ambition of the business combination is to have a lasting impact on the travel retail & F&B industry by refining the experience for travellers, and create revenue and cost synergies for the newly combined Group. For a successful combination, announcing the leadership representatives of both companies as well as creating a “One Team/One Company” spirit were key first steps of the integration process.

Von Katharina Kukiolka, Andrea Lingk und Christoph Schmidt

Die ETH Zürich ist eine der führenden technischen Hochschulen der Welt. Sie ist dezentral organisiert und möchte die Vielfalt in der Einheit bewahren. Davon geprägt war auch die Weiterentwicklung der Berichterstattung. Sie war von der Evaluation bis zur Produktion breit abgestützt, was sich schon im Projektverlauf als entscheidender Erfolgsfaktor herausstellte. Das Ergebnis: ein integriertes, strategisches und digital getriebenes Reporting.

Von Ina Walthert

Nachhaltigkeit ist im Kerngeschäft von Unternehmen angekommen. Die Herausforderung besteht darin, den rege verwendeten Begriff mit Taten zu belegen. Unternehmen sind gefordert, die Schaffung von ökologischem und sozialem Mehrwert konsequent in die eigene Value Proposition zu integrieren. Echte Produktinnovation, Transformationsbereitschaft und eine gelungene Kommunikation sind die Essentials für ein glaubwürdiges (Nachhaltigkeits-)Image. Die AMAG Gruppe entwickelt nachhaltige Mobilitätslösungen. Eine herausfordernde Aufgabe auch für die Nachhaltigkeitskommunikation.

By Natasha Santos and Tony Goldner

Risk management is the cornerstone of any successful business. But few businesses understand their exposure to risk from nature loss. A new assessment and disclosure tool aims to change that.

By Marco Märsmann and Alexandra Sauer

Over the last 15 years, Bell Food Group has evolved from a Swiss meat producer into a leading European food company. This brings increasing responsibility and leverage to drive the food system in a more sustainable direction. In addition, the company is subject to CSRD, VSOTR, OR 964, LKSG, SBTi and OECD, amongst others, each of which is backed by a system of disclosure requirements and governance guidance. How to react to this complex situation without losing sight of the own strategic goals?

Von Barbara Zäch mit Manuela Suter

Bucher Industries entwickelt und produziert Landmaschinen, Kommunalfahrzeuge, hydraulische Komponenten und elektrohydraulische Systeme, Produktionsanlagen für die Glasbehälterindustrie, Anlagen für die Herstellung von Getränken sowie Automatisierungslösungen. Der Konzern steht für Maschinen, Anlagen und Komponenten, die technologisch, wirtschaftlich und ökologisch überzeugen und sich auf die grundlegenden Bedürfnisse der Menschen ausrichten.

By Michael Düringer

The 14th Geschäftsberichte-Symposium took place on Wednesday, June 14, 2023 at the Gottlieb Duttweiler Institute (GDI) in Rüschlikon. The Symposium’s timely focus on the latest regulatory requirements in sustainability reporting, along with top-notch keynote speakers, drew a record number of participants. Around 250 guests were on site, while a further 100 attendees joined online via livestream to learn about the latest developments and trends in corporate reporting.

Von Reto Janser und Bernd Kasemir

Seit mehr als 500 Jahren wird das Unternehmen Orell Füssli umsichtig und mit Blick auf Langfristigkeit geführt. Heute ist die Orell Füssli Gruppe ein Pionier in den Bereichen Sicherheit und Bildung. Bis vor Kurzem fehlte der Unternehmensgruppe eine systematische Grundlage zur Erfassung der nichtfinanziellen Leistung. Deshalb konnte diese Leistung nicht transparent kommuniziert werden. Inzwischen fand die Gruppe gemeinsam mit der Nachhaltigkeitsberatung Sustainserv innerhalb kurzer Zeit pragmatische Lösungen für die nichtfinanzielle Berichterstattung, die der Diversität und Komplexität der Geschäftsfelder Rechnung tragen.

By Renat Heuberger

Every action has an equal and opposite reaction. As accusations of greenwashing have rocked the corporate climate space in recent years, we’re seeing a concerning reaction: greenhushing and greenwishing. Some companies are choosing to go quiet on their decarbonization efforts for fear of scrutiny. Others are making bold climate statements but with no verifiable plan of how to achieve them. In the face of the greatest threat humanity has faced, we simply cannot afford to hide what we are doing or make promises without measurable commitments.

Von Fabian Dieziger

Silodenken gehört zu den grössten Herausforderungen im Management. Es ist das Gegenteil einer fruchtbaren Zusammenarbeit – doch genau diese macht erfolgreiches Corporate Reporting aus. Wie geht es also besser?

Von Monika Kovarova-Simecek

Finfluencer erreichen auf Social Media Millionen Follower. Sie prägen den Diskurs zum Kapitalmarkt und beeinflussen die Haltung und das Verhalten vor allem jüngerer Generationen. Damit werden sie auch für Unternehmen zu relevanten Stakeholdern. Die FH St. Pölten untersuchte mit der Agentur Paradots den Einfluss von Finfluencern auf ihre Follower. Zusammen mit der Universität Leipzig und der HHL Leipzig beleuchten wir nun den Finfluencer-Markt.

By Alberto Zampella

Today’s business world is witnessing a transformative shift, driven by the escalating importance of environmental, social, and governance (ESG) factors. stakeholders not only demand transparent insights into an organization’s strategies for environmental risk mitigation, social responsibility and governance practices, but they also keenly observe how businesses innovate and harness the opportunities presented by a shift towards a more sustainable economy.

Von Christoph Schlienkamp

Schon lange haben wir uns bei der DVFA mit der Frage beschäftigt, welchen Einfluss künstliche Intelligenz (KI) für die Investment Professionals haben wird. Heute zeigt sich, dass die KI einen erheblichen Einfluss auf den Finanzmarkt haben wird, da sie die Effizienz erhöhen und die Entscheidungsfindung beschleunigen dürfte. Analysten werden aber nicht verschwinden, Investoren werden zielgerichteter bedient werden können und der «schöne» Geschäftsbericht wird bleiben.

Von Klaus Hufschlag

Die Umsetzung der CSRD stellt viele Unternehmen vor grosse Herausforderungen. DHL Group hat gute Erfahrungen damit gemacht, das Nachhaltigkeitsreporting im Finanzbereich anzusiedeln: Kompetenzen und Infrastruktur, ein gutes Verständnis für Unternehmenssteuerung und – wichtig für die Einführung der EU-Standards zur Nachhaltigkeitsberichterstattung – Erfahrung im Umgang mit komplexen (Accounting-)Regelwerken bringen praktische Vorteile. Gleichzeitig werden traditionelle Aufgabenfelder im Finanzbereich erweitert und ESG-Themenverantwortliche entlastet – eine Win-win-Konstellation.

Von Gian Marco Werro

Als eines der führenden Sell-Side-Researchteams der Schweiz beurteilt die Zürcher Kantonalbank auch die Nachhaltigkeit von 140 kotierten Aktiengesellschaften. Unser ESG-Ansatz berücksichtigt quantitative und qualitative ESG-Faktoren. Dabei werden neben der aktuellen Situation auch ergriffene Massnahmen beurteilt. Doch welche Informationen benötigen Sell-Side-Analysten, um mit Nachhaltigkeitsberichten effizient arbeiten zu können?

By Steffen Rufenach

In July 2023, the European Commission introduced the first set of European Sustainability Reporting Standards (ESRS), mandating more than 50,000 companies to improve their sustainability reporting. One pivotal part of ESRS is the “double materiality” assessment, which requires companies to evaluate and report on how their business and value chain affects people and the environment (the “inside-out” perspective) and, conversely, how sustainability issues impact their business (the “outside-in” perspective).

Jenny Butterweck

Mit der Rubrik «Auf ein Wort mit …» will «The Reporting Times» regelmässig bekannte Mitglieder der Reporting Community von ihrer ganz persönlichen Seite zeigen.

Inserenten

Herzlichen Dank unseren Inserenten!

Ein herzliches Dankeschön an unsere Platinpartner FS Parker, MDD – Management Digital Data AG, NeidhartSchön und Supertext Schweiz, ohne deren Unterstützung die Realisation dieser Fachpublikation jeweils nicht möglich wäre.

Ebenfalls bedanken wir uns bei allen Inserenten der aktuellen Ausgabe:

1/1 Seite

1/2 Seite

1/3 Seite

Beilage (DE)

Welche Angebote möchten Sie intelligent bei Ihren Zielgruppen positionieren? Wir helfen Ihnen mit der Zusammenstellung eines individuellen Positionierungs-Pakets.

Impressum

The Reporting Times ist die Zeitung des Center for Corporate Reporting (CCR), Zürich.

Herausgeber: Reto Schneider

Redaktion & Projektmanagement: Helen Gloor, Walter Thomas Lutz, Stefanie Matt, Thomas Scheiwiller, Walter Vaterlaus, Carol Winiger, Barbara Zäch

Art Direction und Design: FS Parker

Illustrationen: Muti (Titelseite), Anne Lück (Porträts)

Produktion: Neidhart + Schön Group AG

Copyright: Center for Corporate Reporting c/o Geschäftsberichte-Symposium AG, Dorfstrasse 29, 8037 Zürich

www.corporate-reporting.com

www.gb-symposium.ch

www.reporting-times.com

www.reporting-monitor.com